News

2017 Global OCA Optical Adhesive and Vehicle Display Market Scale Analysis

Release time:

2023-04-24 16:52

1. OCA optical glue is an important raw material for touch screen

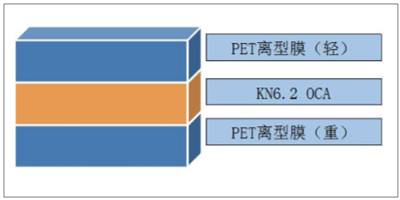

OCA optical adhesive is a special adhesive used for bonding transparent optical components, which belongs to the category of pressure-sensitive adhesives. It makes optical acrylic adhesive without base material, and then laminates a layer of release film on the upper and lower base layers to form a high-transparency double-sided lamination tape without base material.

As one of the important raw materials of the touch screen, OCA optical glue is mainly used for bonding materials on the touch screen, which has the effect of capacitive touch sensing, and has high clarity, strong light transmission (total light transmittance >99%), High adhesion, water and high temperature resistance, UV resistance, good bonding strength and other characteristics.

OCA optical adhesive structure diagram

Data source: Compilation of public information

Related report: "2017-2023 China's In-vehicle Display Market In-Depth Research and Development Prospect Analysis Report" released by Zhiyan Consulting

Application of OCA optical glue in touch screen

Data source: Compilation of public information

2. Demand growth once benefited from the full bonding technology, and the second time benefited from the rise of OLED

1. OCA glue benefits from the popularity of full-fit screens

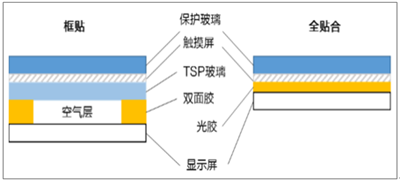

The mobile phone screen mainly consists of three parts: protective glass, touch screen, and display screen, and these three parts need to be bonded. According to the bonding method, it can be divided into two types: full bonding and frame bonding.

Frame stickers are also called word-and-mouth glue bonding, that is, simply use double-sided tape to fix the four sides of the touch screen and display screen. This method is simple in process and low in cost. The full lamination technology uses water glue or optical glue to completely bond the panel and touch screen together in a seamless manner.

Comparison of framed and fully laminated structures

Data source: Compilation of public information

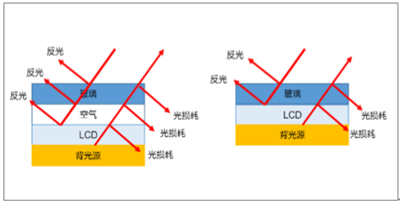

The full fit keeps the screen clean and reduces light reflection and loss. In the full bonding method, since the panel and the touch screen are completely bonded, there is no air layer, which can prevent environmental dust and water vapor pollution, and fully maintain the cleanliness of the screen. In addition, canceling the air between the screens can greatly reduce light reflection, improve the contrast of the display under strong light, and reduce the loss of transmitted light to improve brightness, which is conducive to better display effects. Therefore, full bonding technology has gradually become TFT-LCD. Standard for high-end smartphones of the era. Compared with frame stickers, the amount of OCA optical glue used in full lamination technology has increased significantly, which has greatly increased the demand for OCA.

Full fit reduces reflections and light loss

Data source: Compilation of public information

2. OCA glue benefits from the rise of OLED

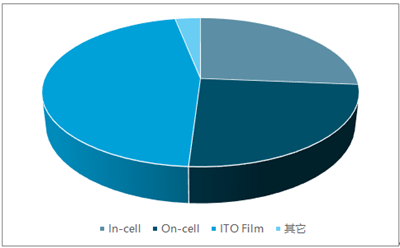

In the era of LCD display screens, Out-cell, In-cell and On-cell solutions are widely used. Due to the thinner and lighter features of In-cell, Apple began to adopt the In-cell touch solution in the iPhone 5 series in 2012 to replace the previous GG solution. Samsung used the On-cell solution on the flagship Galaxy, and Out- Due to its low cost, the cell solution is widely used in various low-end and mid-end models.

In-cell has gradually become the mainstream choice in the market. In order to maintain the lightness and image quality of the fuselage, Apple has continued the In-cell solution after the iPhone 5, and the global market share of In-cell has also continued to increase, squeezing the market space of Out-cell. According to data, the overall market share of In-cell and On-cell solutions reached 51% in 2016, and is expected to further increase to 55.6% in 2017.

Proportion of Global Smartphone Touch Solutions in 2016

\

\

Data source: Compilation of public information

Proportion of Global Smartphone Touch Solutions in 2017

Data source: Compilation of public information

3. The upstream production capacity has been monopolized by the United States, Japan and South Korea for a long time, and the downstream die-cutting requirements are high

In terms of upstream materials, currently foreign companies producing OCA optical adhesives are concentrated in the United States, Japan and South Korea, which may easily lead to insufficient domestic supply. The production capacity of OCA optical glue produced by 3M in the United States is occupied by traditional display manufacturers. Except for Mitsubishi’s external supply of OCA optical glue produced in Japan, the production capacity of other manufacturers is generally only enough for their own touch screen related companies. With the rise of touch screen full lamination, the demand for OCA has increased, and the market has fallen into a state of short supply. The most serious production capacity gap occurred in 2014. Many domestic mobile phones missed market opportunities because they could not obtain qualified OCA.

In 2016, the global market for OCA optical adhesives was approximately USD 810 million. In 2017, it is estimated to be close to USD 900 million. With the popularization of new applications such as automotive electronics, smart manufacturing, and smart homes, the demand for OCA optical adhesives will enter a fast-growing channel. It is expected that by 2020 annual will be close to 1.05 billion US dollars.

Global OCA Optical Adhesive Market Size (Unit: US$100 million)

Data source: Compilation of public information

4. my country is still at the bottom of the fluorine chemical industry chain as a whole, and consumption and production capacity do not match

my country is the largest consumer of fluoropolymers in the world. In 2012, the global consumption of fluoropolymers was about 245,400 tons, of which China accounted for 29.5%, the United States accounted for 28.4%, Western Europe accounted for 21.35%, and Japan accounted for 9.05%.

Fluoropolymer Consumption by Countries in the World in 2012

Data source: Compilation of public information

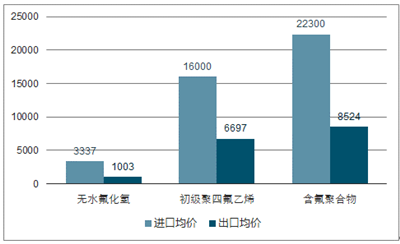

Although my country is already the largest country in the fluorine chemical industry, the competition for low-end and mid-end products is fierce, and the share of high-end products is insufficient. Especially in the fields of new fluorosilicon materials and other fields, the development is relatively lagging behind, and there is a lack of high-performance, specialized, serialized, and refined products. The specific performance is that the product self-sufficiency rate is low and the average price of import and export is very different: in 2016, the average import price of anhydrous hydrogen fluoride was 3337 US dollars / ton, and the average export price was 1003 US dollars / ton; the average import price of primary PTFE was higher than 16,000 US dollars / ton. tons, the average export price is US$6,697/ton; the average import price of fluoropolymers is US$22,300/ton, and the average export price is US$8,524/ton.

The average price of import and export of fluorine products in 2016 is very different

Data source: Compilation of public information

5. Fluorosilicone coatings are widely used in waterproof and stain-resistant fields

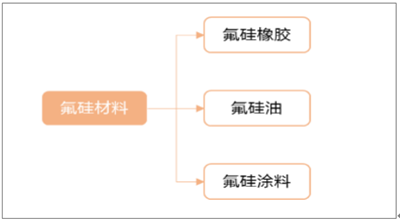

Organofluorosilicon material is a cross material of organic silicon and organic fluorine. The product performance has both the characteristics of organic silicon and fluorine products, and has the characteristics of low surface tension, good solvent resistance and chemical resistance. The superior properties of fluorine and silicon make them widely used in many fields such as electronics, aerospace, automobiles, textiles, etc., but their synthesis process is relatively difficult, and has always been a research hotspot in the field of new materials. Fluorosilicone material products mainly include fluorosilicone rubber, fluorosilicone oil and fluorosilicone coating.

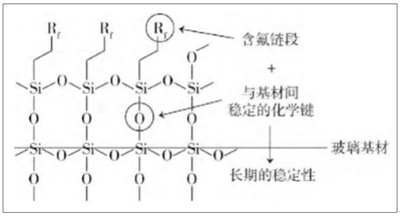

Fluorosilicon coatings are widely used in the surface treatment of silicon-based materials such as glass and ceramics, such as automobile windshields, architectural glass, mobile phone glass casings, ceramic handicrafts and ceramic sanitary products. The silanol in the coating can condense with the silanol of the substrate to form a strong chemical bond to provide strong adhesion, and the fluorine-containing segment can provide excellent waterproof, stain resistance and weather resistance.

Fluorosilicone material main products

Data source: Compilation of public information

The principle of fluorosilicone coating acting on glass substrate

Data source: Compilation of public information

6. The demand for double glass and automotive display coatings is increasing

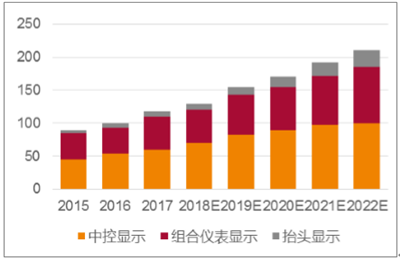

At present, TFT LCD is the mainstream of vehicle display. According to data, the global automotive display market size in 2017 was approximately US$12 billion, and it is expected that the overall market size will exceed US$20 billion by 2022. Currently, the top five automotive LCD display manufacturers in the world are JDI, Innolux, Sharp, AUO and LGD.

Touch panels gradually entered the automotive market and became standard equipment. Despite safety concerns about operating a touchscreen while driving, in-vehicle touchscreen panels are becoming standard equipment on new cars entering the market. It transforms the role of automotive displays from simple visual information presentation to a real human-machine interface. Global shipments of automotive touch panels are expected to be 50 million units in 2017, and are expected to exceed 65 million units by 2021. Domestic panel manufacturers such as BOE are accelerating the implementation of the strategic layout of vehicle touch screens and displays.

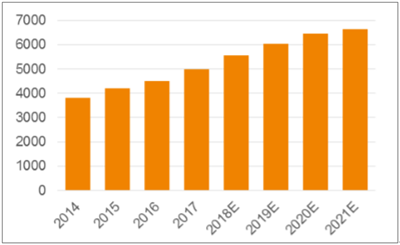

Forecast of global vehicle display market size (unit: US$100 million)

Data source: Compilation of public information

Global Automotive Touch Screen Shipment Forecast (Unit: Ten Thousand Units)

Data source: Compilation of public information

Compared with the screens of consumer electronic products such as mobile phones, automotive display screens have higher requirements for safety, and the demand for anti-glare display is more urgent. Based on its main business of automotive coatings, Yitaiji can use its inherent downstream customers to play a synergistic role and quickly enter the expansion of fluorosilicon products in the automotive display coating market.